Questions You Should Ask Before Reaffirming A Car Loan

Reaffirming debt is serious business. Once you reaffirm a debt you are making a promise to the creditor that you will repay the debt as though it was never part of your bankruptcy. And if you fail to make timely payments or default on the reaffirmed debt, your financial troubles—wage garnishments, bank levies, and lawsuits could start all over again. But you may feel that reaffirming your debt, especially a car loan, is necessary because you need your vehicle just to get back and forth to work. If you want to reduce the risk that comes with debt reaffirmation, there are a few things you should ask before you reaffirm debt in bankruptcy.

Reaffirming debt is serious business. Once you reaffirm a debt you are making a promise to the creditor that you will repay the debt as though it was never part of your bankruptcy. And if you fail to make timely payments or default on the reaffirmed debt, your financial troubles—wage garnishments, bank levies, and lawsuits could start all over again. But you may feel that reaffirming your debt, especially a car loan, is necessary because you need your vehicle just to get back and forth to work. If you want to reduce the risk that comes with debt reaffirmation, there are a few things you should ask before you reaffirm debt in bankruptcy.

1. Is this in your best interests? There are good loans and there are bad loans. Unfortunately, many car loans are bad especially if you financed your vehicle through a subprime lender. You need to carefully examine the terms of your reaffirmation agreement and the original car loan to make sure that the terms and conditions are really in your favor. For example, if you find that your car loan is for an amount that’s significantly more than the value of your vehicle, then debt reaffirmation in bankruptcy may be a very bad idea.

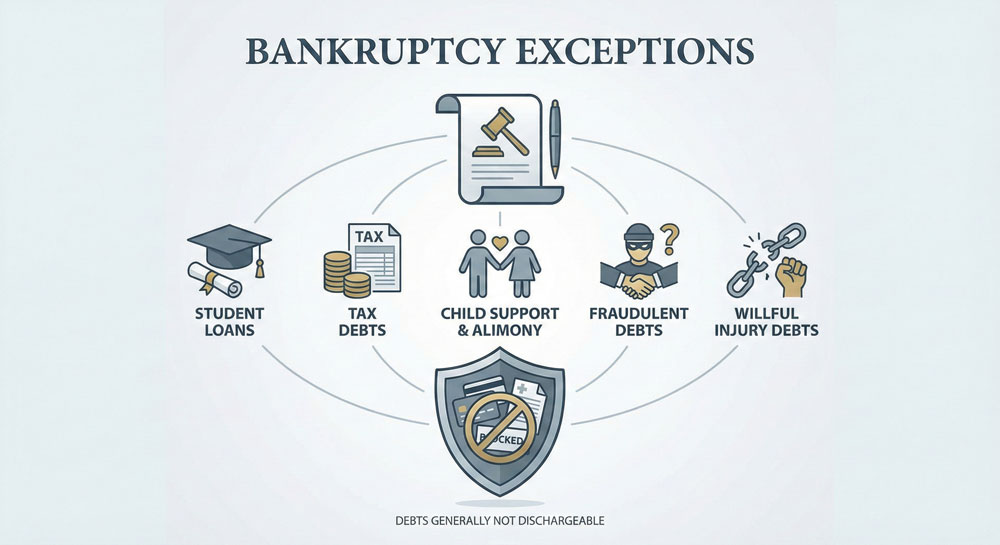

2. Can you afford it? Even if the reaffirmation and loan terms are fair and in your best interests, your finances may not be ready to take on such a burden. Think about your financial responsibilities after bankruptcy. What is your budget? What debts will be discharged and which will stay with you? For example, if you must repay your student loans and child support payments, can you really afford an expensive car note especially if you have a low-paying job?

3. Is there an alternative to reaffirmation? If you’re feeling pressured to sign a reaffirmation agreement because you need your vehicle after bankruptcy, you may have an alternative. Many lenders are willing to accept payments from you and allow you to keep your vehicle even if you never sign a reaffirmation agreement. This means that without the reaffirmation agreement, you wouldn’t face lawsuits and other aggressive collections actions if you failed to pay the debt after bankruptcy. Without a reaffirmation agreement, failure to pay means that you must surrender your vehicle to the lender. You might also consider dropping your car loan, returning your vehicle, and buying a cheaper car for cash. It’s a lot safer than risking your financial fresh start by reaffirming debt that you should really discharge in bankruptcy.

4. Will the bankruptcy court agree? Even if you decide that you want to reaffirm a debt in bankruptcy, the trustee can stop you. If the bankruptcy court determines that signing a reaffirmation agreement would work against the fresh financial start bankruptcy is supposed to give, they can prevent you from signing it.

If you want to find out how keep your vehicle or other property in bankruptcy, call us today.