How To Get Out Of Payday Loan Debt

The internet is littered with stories of payday loan nightmares. Most stories have the same common thread: an individual gets into a financial bind or suffers an incident that requires fast cash they don’t have, goes to a payday loan outlet, and gets instant access to the cash they need. Seems like a great deal right? Well what happens next, is unfortunately, also common place. You may be able to pay off the loan on time, but come up short the next month and are forced to return to the payday loan outlet. If you miss even one payment during this cycle the interest rates and fees balloon out of control and then the collection attempts begin. Before you know it, you are getting daily debt collection phone calls or even sued for the astronomical amount of interest plus the original loan balance. If this sounds like a familiar story, it’s because nearly 12 million Americans get caught up in the payday loan debt cycle every year. This equates to a whopping 9 billion dollars in loan fees.

How to Get Out of Payday Loan Debt

So, payday loan companies actually make more money when you do not pay back the loans. If you’re caught up in this vicious cycle,, how do you get relief? The good news is that depending on where you live, you most likely have several different options for getting out of your payday loan. If you have fallen behind with a lender that is a member of the Community Financial Services Association of America (CFSA), you should have access to an EPP, or extended payment plan. Under these plans you can get additional time to pay back the loan without huge fees, interest penalties, or being turned over to a collection agency.

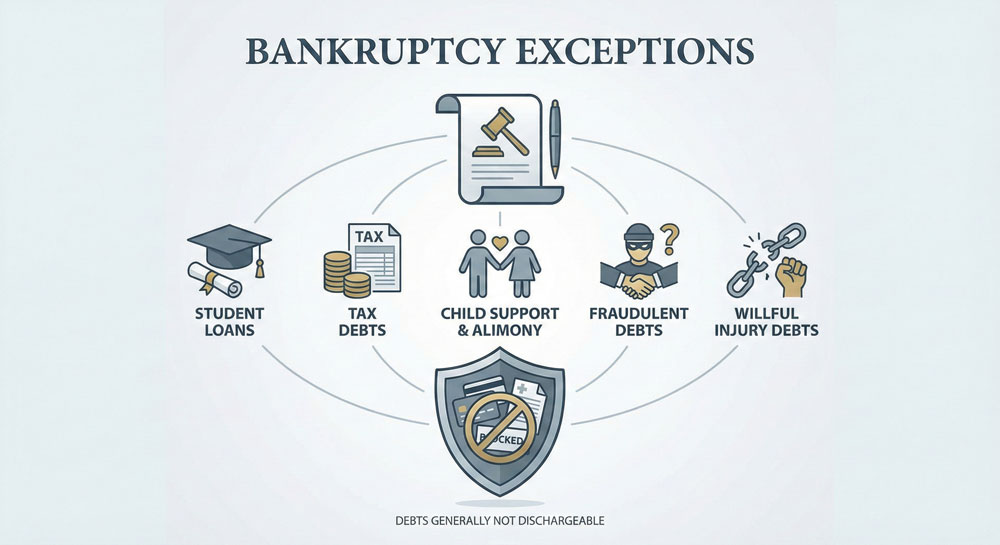

The only certain way to eliminate payday loan debt, is to file for Chapter 7 or Chapter 13 bankruptcy. This seems like a drastic measure, but it’s the only sure fire way to stop collection activities, as well as, discharge the debt.

Payday Loan Credit Checks

Taking out a payday loan is relatively easy; however, as many find out, they can be extraordinarily hard to pay off. Payday loans are so easy to take out, in fact, that the U.S. Government has been working to crack down on lenders via the Consumer Financial Protection Bureau who has renewed efforts to enlist laws that require the lenders to check a consumer’s ability to pay back the loan before handing over the cash. The payday loan community, whether intentional or not, currently receives the bulk of its customers from the poorest populations that are already on rocky financial ground.

If you are currently caught up in the vicious payday loan cycle that you can’t get out of, there is help available to you. Contact a Modesto bankruptcy lawyer immediately who is well versed in different debt relief methods.

Categorized in: Loans