Credit Cards In Chapter 13 Bankruptcy

Credit Card debt is a major contributor to the overall U.S. household debt, and therefore is a common thing to deal with during a bankruptcy. We are often asked what happens to credit cards in a Chapter 13 bankruptcy, including: Can I keep using a credit card during bankruptcy? What happens to my credit card balance when I file bankruptcy? Can I keep a credit card during bankruptcy for emergencies?

Credit Card debt is a major contributor to the overall U.S. household debt, and therefore is a common thing to deal with during a bankruptcy. We are often asked what happens to credit cards in a Chapter 13 bankruptcy, including: Can I keep using a credit card during bankruptcy? What happens to my credit card balance when I file bankruptcy? Can I keep a credit card during bankruptcy for emergencies?

During a Chapter 13 bankruptcy, you, your bankruptcy attorney in Sacramento, and the bankruptcy trustee will be taking a close look at your financial situation and finding a payment plan that will allow you to continue to earn an income while paying back your debt.

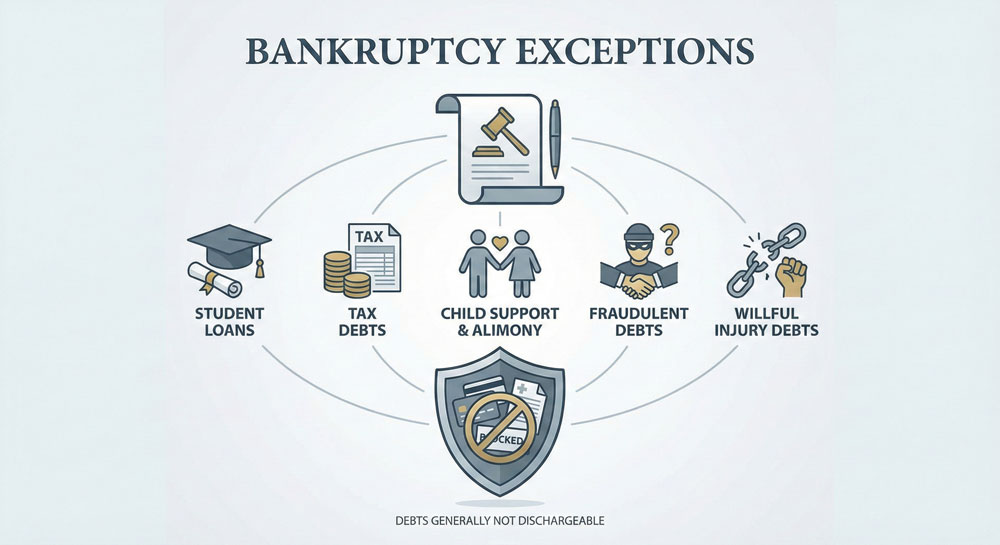

Credit Card debt in bankruptcy is typically designated as a general unsecured debt, which has the lowest repayment priority compared to secured debt such as your mortgage and auto payment or with priority unsecured debt such as alimony and income tax. The good news for debtors filing Chapter 13 bankruptcy with a large amount of credit card debt is that you may not have to pay back the total amount owed on your credit cards. That’s assuming that your credit card debt is not classified as secured.

The bad news is that once your credit card company(s) gets the news that you are filing bankruptcy in Sacramento they will most likely cancel your card, and therefore you will be unable to use it or tuck it away for a rainy day. This makes sense as credit card debt can be very burdensome, and so the Chapter 13 bankruptcy is design to keep you from assuming more debt. The good news is that once you file Chapter 13 bankruptcy, it will be approved if you can show that you can pay your secured and priority unsecured debts. As long as you complete your 3-5 year payment plan, then any general unsecured debt will be discharged at the end of the process, and offer you a fresh new start towards a positive financial future.

Categorized in: Credit