What Is A Chapter 13 Bankruptcy Confirmation Hearing?

If you filed a Chapter 13 bankruptcy in California, you must also file a repayment plan with your bankruptcy petition or submit one within 14 days of filing your case. Your proposed repayment plan must provide a reasonable and feasible plan for paying back creditors. Let’s take a look at a few things you need to know about the bankruptcy confirmation hearing.

If you filed a Chapter 13 bankruptcy in California, you must also file a repayment plan with your bankruptcy petition or submit one within 14 days of filing your case. Your proposed repayment plan must provide a reasonable and feasible plan for paying back creditors. Let’s take a look at a few things you need to know about the bankruptcy confirmation hearing.

Timing

The bankruptcy confirmation hearing usually takes place within 45 days after your meeting of the creditors (341 meeting). However, even if you haven’t had your confirmation hearing, you must begin making plan payments to the trustee—check with your attorney to see when your payments are due. This means that even if your plan has not been approved, you must begin making payments based on the proposed plan. So once you craft a Chapter 13 repayment plan, make sure that you are immediately capable of making the payments.

Objections

Once the bankruptcy trustee has received your proposed repayment plan, the trustee will review it to determine if the plan is feasible and if it meets the standards of the law. The bankruptcy court will also send your creditors a 28-day notice of the confirmation hearing. It’s at this hearing the creditors can object to your proposed repayment plan. Some common reasons a creditor may object to a bankruptcy repayment plan are:

- The creditors will receive less under the proposed repayment plan than they would if your assets were liquidated and the proceeds were distributed to the creditors.

- The repayment plan does not commit all of your disposable income to repaying creditors in bankruptcy.

If there are no objections and the trustee finds the proposed repayment plan feasible and lawful, the court will approve the plan at the confirmation hearing.

If the bankruptcy trustee rejects the proposed repayment plan because it’s not feasible, lawful, or because creditors had valid objections, the court may deny confirmation of your Chapter 13 plan, in which case you and your attorney will have to fix the problems identified by the court.

Revisions

Objections at a confirmation hearing are possible, but these objections don’t mean your Chapter 13 case is over. You and your attorney may revise your repayment plan and re-file it with the court. The creditors and trustee will then review the amended plan and have another opportunity to object.

Confirmation

Once the court confirms your Chapter 13 plan, the trustee’s office will begin making general distributions to your creditors from the payments you’ve already made. It’s important that you pay on or before your due date. Failure to pay your Chapter 13 bankruptcy plan on time could cause your case to be dismissed. The dismissal of your case means that your debt will be treated as though you never filed. Your creditors will begin pursuing you personally for full payment of the debts you owe.

Conversion

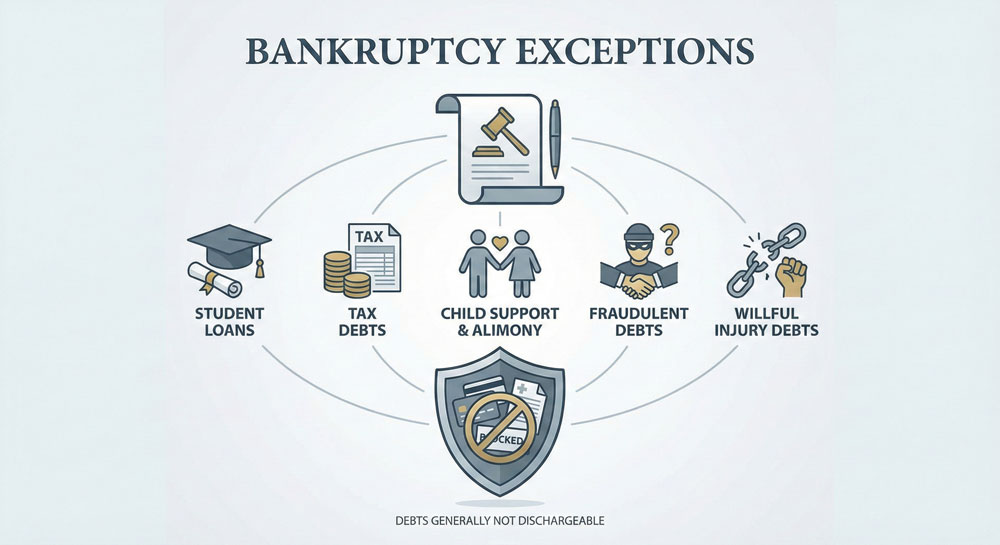

If you’re unable to get your Chapter 13 plan approved because you simply cannot afford it or because your financial circumstances have changed, you may be able to convert your case to a Chapter 7 bankruptcy. Conversion to Chapter 7 bankruptcy will mean that most or even all of your unsecured debts will be discharged.

To find out more about Chapter 13 and Chapter 7 bankruptcy, call us today.

Categorized in: Chapter 13