Debt Settlement Vs. Chapter 13

In their first calls to my office, many people have asked, “What is the difference between debt settlement and Chapter 13 bankruptcy?” At a glance, they’re pretty similar. Once entered, a person pays a portion of their debt and the rest of their debt is forgiven when completed (with a few noted exceptions).

That last sentence could describe either debt settlement or Chapter 13 and without more information one might choose the wrong one when the other is better for them. It is important to understand the differences between each before committing to one or the other.

THE DIFFERENCES

The biggest difference between debt settlement and Chapter 13 bankruptcy has to be the process of reaching the “negotiated” repayment. The quotations around the word “negotiated” will make sense in a moment.

In debt settlement, you (or perhaps, a debt settlement company you are paying to negotiate on your behalf) will engage your creditors to negotiate your settlement offer. Initial contact with your creditors will typically result in written responses concerning your interest in “loss mitigation” or “settlement” options.

In debt settlement, each agreement is distinct and separate from the others and you will be responsible for coming up with a repayment figure that each individual creditor (or perhaps, a debt collection company they are paying to collect on their behalf, or sold the debt to) will accept. These numbers can vary widely and can produce unpredictable outcomes because, unlike bankruptcy, when starting with debt settlement one cannot feel very confident about the total amount they are going to be paying to their creditors. This has the nasty secondary effect of hindering one’s ability to properly “budget” for a successful total settlement of their debts unless they have money on hand that represents nearly, or exceeds, 100% of their debts.

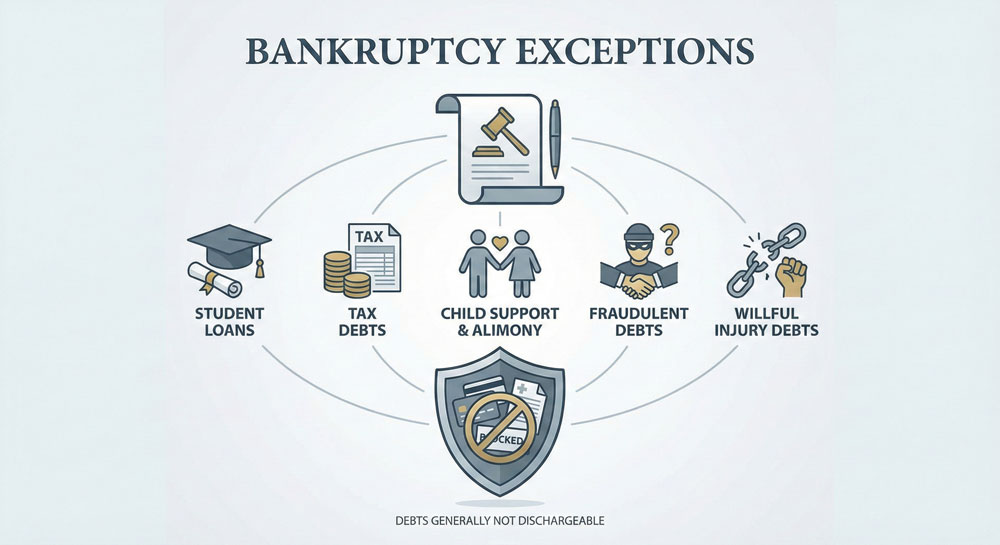

In contrast, Chapter 13 bankruptcy puts your debts together into a “plan” to repay the debts over a five year period. Rather than any “negotiation” taking place between the court and each creditor, a formula called the “Means Test” is used to create a monthly payment. If the payment terms are completed, the court will permit a filer to discharge any remaining debt (with the exception of student loans and court-ordered debts) in their name.

The formula behind the means test uses data about the filing party(s), such as their location, income, household size and more to determine a filer’s monthly payment. There are certain debts that must be repaid, such as mortgage arrears, vehicle loans and most tax debts.

Based on the facts of one’s case, one might show that they are capable of repaying between 0 and 100% of their unsecured, non-priority debt. Consequently, if the court indicates you can only repay a very small percentage of this debt, you may find that you are saving a substantial amount compared to the amount you would through debt settlement. However, some folks will find that the court indicates they can pay back up to 100% of the debt owed.

Why file bankruptcy if you are paying back all your debt? Why not just do debt settlement? In theory, even if you’re only saving a small amount, you’d still be finishing ahead when compared to a 100% repayment via bankruptcy, right? This isn’t always so. Unlike bankruptcy, debt settlement comes with tax consequences in the form of a 1099-C, aka a statement for “Cancellation of Debt Income”. That’s right! You have to pay income taxes on any amount you saved through a debt settlement. Suddenly the total you thought you were saving through debt settlement is substantially less!

WHY SETTLE, THEN?

By now you’re probably wondering, why you would settle your debts outside of a bankruptcy courtroom? Many of our eventual clients attempt debt settlement and then later come to the realization that bankruptcy would have been better.

The primary advantage to debt settlement is retaining your financial flexibility with your assets. Since this process is not overseen by a court, you are able to sell assets, acquire more debt, etc. in order to complete your settlement with your creditors. In chapter 13, many of these acts take the permission of a court, which can take around a month and a half to receive, before you can proceed with selling an asset or acquiring any kind of debt, the latter of which can result in an increase in your plan payment along with a denial of the action. If you find yourself in this position, please consult with your bankruptcy attorney before proceeding with any sale of property or acquiring of debt.

CONCLUSION

Before making a commitment, one must carefully evaluate their situation to see if protection from the court through bankruptcy is a good option for them or if they should go it alone with debt settlement. If you are thinking about either one of these options, it’s likely that you should be comparing both.

For more information contact your Yuba City bankruptcy attorney at (530) 797-4402.

Categorized in: Chapter 13