Bankruptcy Basics: What Is A Trustee?

If you’re filing Chapter 7 or Chapter 13 bankruptcy, you will have an impartial trustee administer your case. A bankruptcy trustee has a variety of responsibilities in your case, so let’s take closer look their job.

If you’re filing Chapter 7 or Chapter 13 bankruptcy, you will have an impartial trustee administer your case. A bankruptcy trustee has a variety of responsibilities in your case, so let’s take closer look their job.

Review Your Petition

The appointed bankruptcy trustee in your case is responsible for reviewing your bankruptcy petition. They will examine all of the documents you submit with your petition and look for any inaccuracies, unclear information, and any sign that the petition may have been filed in bad faith.

Oversee 341 Meeting

Once the trustee reviews your bankruptcy petition, they will question you at the 341 meeting (also known as the meeting of creditors). At this meeting the bankruptcy trustee is responsible for clarifying information when necessary, pointing out anything that seems inaccurate, and oversee any questioning that creditors conduct with you. It’s not the job of the trustee to be a “good cop, bad cop” persona where they drill you with a bunch of tough questions, but it is up to them to get to the truth. Don’t allow yourself to get too worried about this aspect of the trustee’s job because you will be at this meeting with your attorney, such as yours truly.

Sell Assets

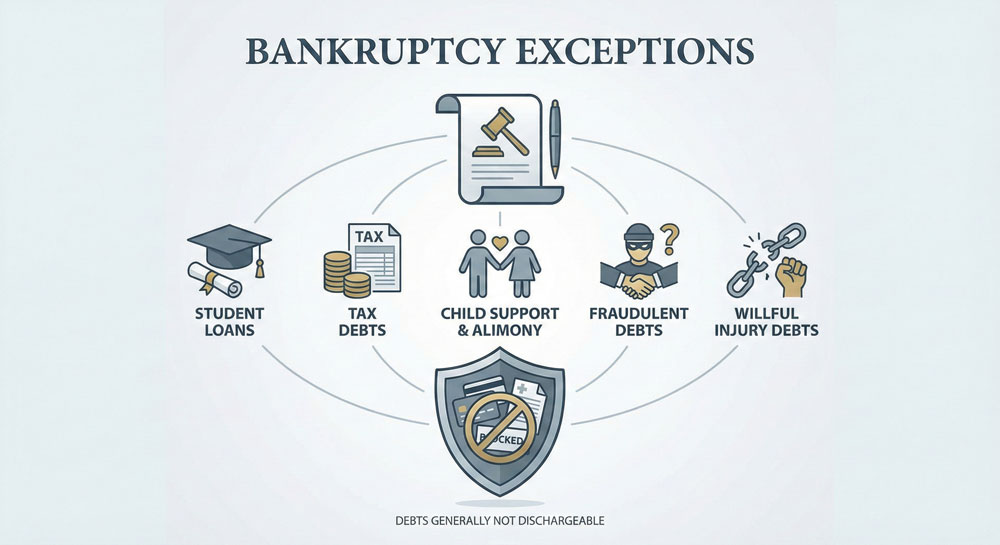

If you’ve seen any celebrity bankruptcies in court, you probably remember their designer clothes and expensive furniture being auctioned off. Well, you can relax because that’s not likely to happen to you. While it is the responsibility of your bankruptcy trustee to sell off assets so that the proceeds can be used to repay creditors, most debtors are mostly covered by bankruptcy exemptions. Bankruptcy exemptions basically protect your assets from being sold off at auction. This means that your books, clothes, furniture, and yes, even your designer handbags won’t be touched by the trustee or creditors as long as they are covered by bankruptcy exemptions. And in most cases the ordinary debtor’s personal possessions are protected. But property such as a second home or luxury sail boat that is not covered by bankruptcy exemption could be auctioned off by the trustee to pay off creditors. But remember, it’s also the responsibility of the trustee to make sure that any property auctioned off is actually worth the effort. In some cases, even if the property is not covered by exemptions, it is worth too little to go through the trouble and expense of liquidation.

Manage Repayment

In the case of a Chapter 13 bankruptcy, the trustee is responsible for recommending that the court confirm or deny the debtor’s proposed repayment plan. Once a plan is confirmed, the Chapter 13 trustee’s office makes payments to creditors consistent with the terms of the confirmed plan. In essence, the trustee will need to determine if the Chapter 13 bankruptcy plan is fair to creditors. If it’s fair, the trustee recommends that the court confirm the plan—if it’s not fair, then the trustee objects to confirmation and the plan is usually denied.

Recover Assets

If you transferred assets or cash to family, friends, or business associates right before filing bankruptcy, it’s the Chapter 7 trustee’s responsibility to recover those funds and assets. Since the trustee’s primary responsibility is to make sure creditors get paid, they will closely look at asset transfers and take action if necessary.

Protect Creditors

It’s important to understand that the bankruptcy trustee’s primary responsibility is to protect the interests of creditors. This is why working with a good California bankruptcy attorney is critical. Call me today to find out how we can help you protect your interests as a debtor.

Categorized in: Bankruptcy